Grants for Tiny Homes: Eligibility and Options

Nomad Adjacent2 months ago

Grants for Tiny Homes: Eligibility and Options

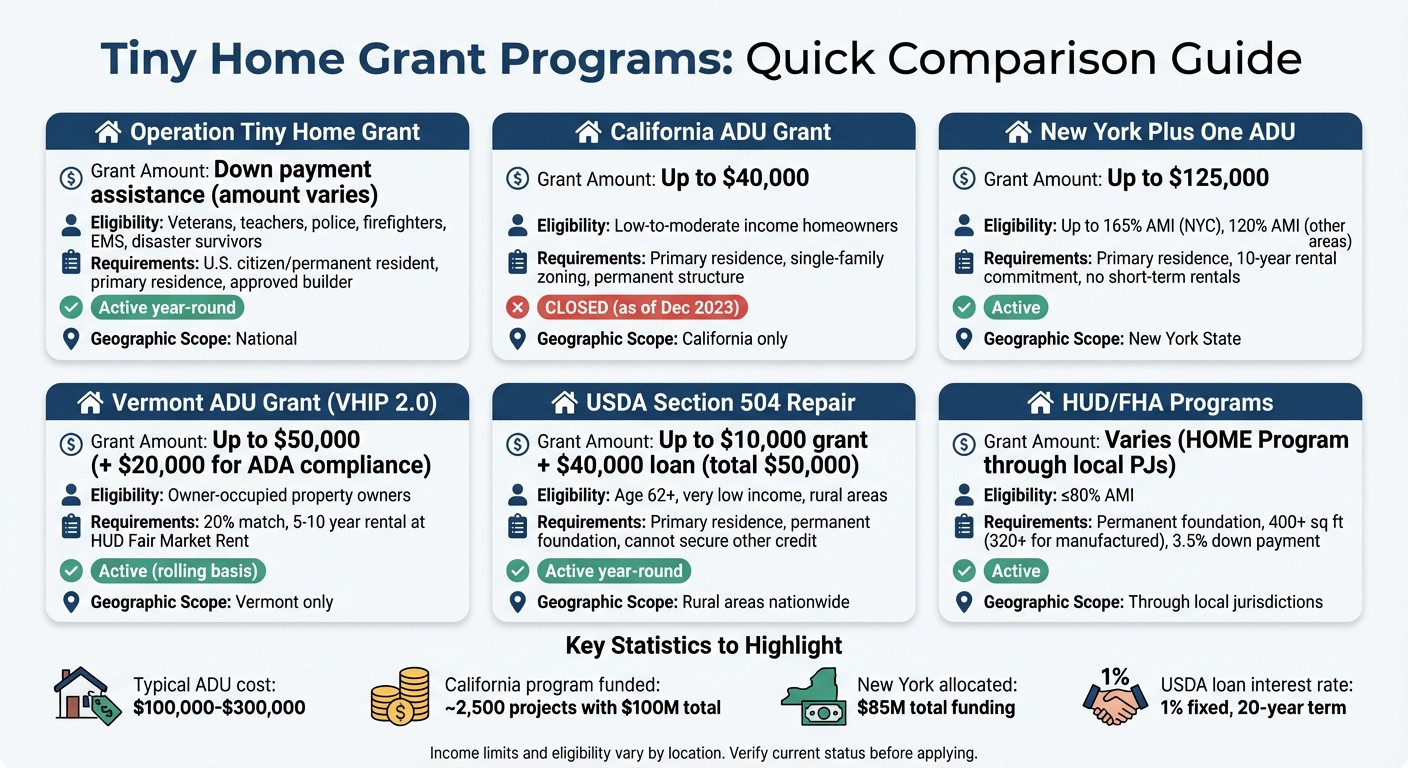

Federal grants for tiny homes are scarce, but state programs and nonprofits are stepping in to help. Options include:

- Operation Tiny Home Grants: Offers down payment assistance for veterans, teachers, and others in need. Year-round applications.

- California ADU Grants: Provided up to $40,000 for pre-development costs. Currently closed.

- New York ADU Program: Grants up to $125,000 for tiny home ADUs. Active with income-based eligibility.

- Vermont ADU Grants: Up to $50,000 for construction, with rental restrictions. Competitive funding.

- USDA Repair Loans/Grants: Up to $50,000 for rural homeowners to upgrade or repair permanent tiny homes.

- HUD Programs: FHA loans and HOME funding for tiny homes on permanent foundations.

These programs often require proof of residence, income limits, and compliance with local zoning laws. Act fast as funds are limited and competitive.

Tiny Home Grant Programs Comparison: Amounts, Eligibility & Requirements

How Do I Apply For A Housing Grant? - CountyOffice.org

1. Operation Tiny Home Grant Program

Operation Tiny Home tackles one of the biggest hurdles in affordable housing: down payments. Through its Welcome Home Down Payment Assistance Grant Program, the organization aims to make tiny home ownership more accessible. The program is designed to assist Community Heroes - like veterans, police officers, firefighters, EMS personnel, and teachers - as well as individuals facing significant challenges such as natural disasters, illness, disability, aging out of foster care, or being a surviving spouse.

Eligibility Requirements

To qualify, applicants must:

- Be U.S. citizens or permanent residents.

- Use the tiny home as their primary residence.

- Demonstrate a genuine housing need.

- Obtain pre-approval for a bank loan from an approved builder.

While there are no specific income limits, applicants need to secure a verified, long-term legal location for their tiny home before applying.

Once you meet these requirements, you can move forward to explore the funding details.

Grant Amount and Funding Support

The program provides down payment assistance, though the exact amount isn't disclosed. To benefit, applicants must work with an approved builder, such as:

- Tumbleweed Tiny Homes

- California Tiny House

- Tiny Mountain Houses

- Cornerstone Tiny Homes

- Tiny Idahomes

If your preferred builder isn’t listed, they can apply to join the program.

Application Process and Deadlines

Here’s how to get started:

- Contact an approved builder to discuss your needs and secure a bank loan pre-approval.

- Once pre-approved, the builder will evaluate your eligibility and request a grant invitation on your behalf.

- Complete the required background check and phone interview within 14 business days.

The program operates year-round, so there are no fixed application deadlines.

2. California ADU Grant Program

The California Housing Finance Agency (CalHFA) launched the ADU Grant Program to help homeowners cover pre-development costs for accessory dwelling units (ADUs), including tiny homes. With a total of $100 million in funding, the program supported around 2,500 ADU projects across the state.

Eligibility Requirements

To qualify, the property must be located in California, serve as the homeowner's primary residence, and fall under single-family zoning rules. The program was specifically aimed at low- to moderate-income homeowners, with income limits varying by county. Eligible ADUs included backyard cottages, secondary units, and detached structures, but only doublewide manufactured homes met the criteria. If you're considering a tiny home as an ADU, it's essential to confirm with your lender that it meets CalHFA's standards as a permanent backyard cottage.

Once these requirements were met, the program reimbursed homeowners for certain pre-development costs.

Grant Amount and Funding Support

The grant offered up to $40,000 per household to cover pre-development expenses. These included costs for site preparation, architectural designs, permits, soil tests, impact fees, property surveys, energy reports, and non-recurring closing costs, such as interest rate buy-downs. CalHFA Executive Director Tiena Johnson Hall emphasized the program's goal:

"Many homeowners have the land available in their backyard, and we want to make it as easy as possible for them with this grant program".

Application Process and Deadlines

While the program provided significant support, it is currently closed. As of December 28, 2023, all funds have been allocated, and CalHFA is no longer accepting applications. However, for those interested in future opportunities, signing up for CalHFA ADU eNews updates is a good way to stay informed in case additional funding is approved by the state legislature. Homeowners should also keep records of site preparation costs, designs, and permit fees, as these may qualify for reimbursement if new funding becomes available.

3. New York ADU Grant Program

New York's Plus One ADU Program allocates a substantial $85 million from the 2022–2023 State Capital Budget to support the development of tiny home ADUs. This funding focuses on detached, stand-alone tiny homes built on single-family lots, creating a valuable opportunity for homeowners looking to add an ADU in New York [14,18].

Eligibility Requirements

Eligibility for the program depends on location and income. In New York City, homeowners earning up to 165% of the Area Median Income (AMI) - approximately $213,840 for a two-person household - are eligible, with priority given to those earning 100% or less of the AMI ($129,600). For other parts of the state, the income cap is set at 120% of AMI [15,16,19].

Applicants must meet several key requirements:

- Own and occupy the property as their primary residence.

- Be up to date on mortgage payments and property taxes.

- Ensure the property is in a zoning district that allows ADUs.

Additionally, homeowners must agree to a 10-year regulatory commitment to maintain the ADU as permanent housing. This means short-term rentals, such as those listed on Airbnb, are strictly prohibited [14,15,16].

Grant Amount and Funding Support

The program offers grants of up to $125,000 per household, which can be used for construction, design, permitting, and environmental assessments [14,16,17,19]. For instance, in Dutchess County, up to $112,500 of the grant can specifically cover construction costs. In New York City, these grants can also be paired with low- or no-interest capital loans to further support homeowners.

Application Process and Deadlines

Homeowners must apply through Local Program Administrators (LPAs), which are usually non-profit housing organizations or municipal agencies. Direct applications to the state are not accepted. The program is currently active in several counties across New York [14,16,19].

To apply, homeowners should confirm their zoning allows ADUs and prepare necessary documentation, including proof of income, tax returns, utility bills, and mortgage statements [14,16,18]. While some pilot programs, such as New York City's initial round, closed on February 13, 2024, additional funding rounds are expected to roll out as the program continues [15,21].

4. Vermont ADU Grant Program

Vermont's VHIP 2.0 program provides grants and forgivable loans of up to $50,000 for constructing accessory dwelling units (ADUs) on owner-occupied properties, including tiny homes. As of March 25, 2024, applications are accepted on a rolling basis, although funding is competitive. This initiative, like similar programs across the country, aims to make tiny home ownership more accessible.

Eligibility Requirements

To qualify, applicants must own a single-family home where the primary residence or ADU is owner-occupied. They must also be current on property taxes and mortgage payments. A 20% match is required from applicants, which can include in-kind contributions.

Homeowners must agree to rent the unit at or below HUD Fair Market Rent for either 5 or 10 years, depending on the program track they choose. The 5-year option allows ADU owners to bypass working with homeless service organizations and set their own tenant selection criteria. Additionally, landlords cannot require a tenant credit score above 500 and may only charge up to one month's rent as a security deposit. Vermont's program highlights the growing push at the state level to reduce financial challenges for small-scale housing development.

Grant Amount and Funding Support

The program provides up to $50,000 per unit for ADU construction, with an extra $20,000 available to cover costs associated with meeting ADA or Vermont Access Rules standards. Funding is distributed in four stages:

- 35% upfront

- 25% at mid-project

- 25% after final inspection

- 15% upon submission of receipts and lease signing

Application Process and Deadlines

Vermont has simplified the application process to make it more accessible. Homeowners must apply through their regional Homeownership Center, depending on their county. For instance, Champlain Housing Trust serves Chittenden, Franklin, and Grand Isle counties, while RuralEdge assists those in Caledonia, Essex, and Orleans counties.

Applicants are required to complete Fair Housing Training, which includes a quiz and a Landlord-Tenant Mediation video. Regional centers also offer hands-on support, such as site visits, help with finalizing project scope and budget, permitting assistance, and construction oversight throughout the project.

sbb-itb-718b9e4

5. USDA Single Family Housing Repair Loans and Grants

The USDA's Section 504 Home Repair program provides low-interest loans and grants to help very-low-income homeowners in rural areas make necessary repairs, upgrades, and safety improvements to their homes. If you own a tiny home, this program might help you address safety issues or make essential updates.

Eligibility Requirements

To qualify for this program, you must meet the following criteria:

- Own and live in the home as your primary residence.

- Have a household income below the "very low" income limit for your county.

- Be unable to secure affordable credit elsewhere.

- To qualify for grant funds, you must be at least 62 years old.

Additionally, the property must be located in an eligible rural area. You can verify eligibility through the USDA Eligibility Site.

Loan and Grant Details

The program offers loans of up to $40,000 with a fixed 1% interest rate and a 20-year repayment term. Grants of up to $10,000 are available to address health and safety hazards, and in disaster-affected areas, the grant amount increases to $15,000. You can combine loans and grants for a total of up to $50,000 - or $55,000 in disaster areas. Keep in mind, if you sell the property within three years, any grant funds you received must be repaid.

Tiny Homes: Key Considerations

Tiny homes can qualify for this program if they are classified as real estate or considered permanent manufactured housing. This typically means the home must have a permanent foundation and comply with local and state building codes. Tiny homes on wheels, which are often categorized as RVs, usually don’t qualify. To determine if your tiny home meets the USDA's criteria for a single-family home, consult a USDA home loan specialist before applying.

Application Process and Deadlines

Applications are accepted year-round through local Rural Development offices, depending on funding availability. Start by completing Form RD 3550-35 (Intake Form) for prequalification. For a formal application, you'll need to submit the following forms:

- Form RD 410-4 (Uniform Residential Loan Application)

- Form RD 3550-1 (Authorization to Release Information)

- Form RD 3550-4 (Employment and Asset Certification)

Your local USDA office can guide you through the process, from prequalification to final submission. This straightforward application process reflects the USDA's commitment to helping eligible homeowners access the support they need.

6. HUD Funding Options for Tiny Homes

The U.S. Department of Housing and Urban Development (HUD) doesn’t provide direct grants to individuals for tiny homes. Instead, funding is available through FHA-insured loans and the HOME Investment Partnerships Program. These programs are managed by state and local governments, referred to as Participating Jurisdictions (PJs). To get started, contact your local government to find the agency responsible for administering these programs. While this funding differs from direct grants, it offers a practical alternative through loans and partnerships.

Eligibility Requirements

If you plan to use your tiny home as your primary residence, your household income must be no more than 80% of the area median income (AMI) to qualify for homeownership assistance. HUD updates HOME income limits annually, so it’s important to check the specific threshold for your county. Additionally, your tiny home must meet local building codes and PJ rehabilitation standards.

Funding Support and Restrictions

HUD funding comes with specific requirements. For example, your tiny home must be on a permanent foundation; homes on wheels, often classified as RVs, do not qualify. Traditional tiny homes must have at least 400 square feet, while manufactured units require a minimum of 320 square feet. FHA loans require a 3.5% down payment and a credit score of at least 580. After construction or rehabilitation, the property’s value cannot exceed 95% of the median purchase price in your area.

Application Process

Once you’ve reviewed the eligibility criteria and funding details, here’s how to proceed. Start by visiting the HUD Exchange website to locate the agency managing the HOME Program in your region. For FHA loans, connect with local manufactured home dealers or lenders approved by the FHA who specialize in tiny home financing. You’ll need to provide documentation showing your tiny home complies with local building codes and is equipped with water and sewage facilities. If your home is on leased land, HUD requires the lease to have an initial term of at least three years, with a minimum of 180 days’ written notice before termination. Finally, any HOME-assisted projects must be completed within four years to avoid the risk of funding recapture.

How to Apply for Tiny Home Grants

If you're ready to apply for a tiny home grant, it's important to plan carefully. Grant funds are often limited and can disappear quickly. For instance, California's ADU grant program used up its entire $100 million budget between 2021 and 2023, leaving no funds for new applicants by January 2026. Similarly, New York allocated nearly $74 million of its $85 million five-year budget to just 85 municipalities.

The first step is to confirm your property's zoning status. Reach out to your local municipal or county building department to ensure that tiny homes or ADUs are allowed in your area. Some programs, like New York's Plus One ADU Program, require proof that your district has adopted a local resolution permitting these structures. Without the proper zoning approval, your application won't move forward, no matter how strong it is in other areas.

Next, gather all the necessary documentation ahead of time. Most programs will ask for proof of identity, U.S. citizenship or permanent residency, income verification to show you meet Area Median Income (AMI) limits (usually between 60% and 120%, depending on the program), and a detailed project budget. Veterans will also need to provide a DD214 form.

You'll also need to secure a location and builder before applying. Programs typically require proof that you have a legal site for your tiny home, along with confirmation of utility connections like water, sewer, and electricity. Some grants may even require you to work with approved professional builders who are familiar with local building codes and can provide the necessary certifications.

Finally, submit your application as early as possible. Federal programs often have strict deadlines. For example, USDA pre-applications must be submitted by 4:30 p.m. local time for paper submissions or by 11:59 p.m. ET for electronic submissions. Many state programs operate on a first-come, first-served basis or through a competitive review process. If you're applying for federal funding through HUD or USDA, make sure your sponsoring organization is registered on platforms like grants.gov, esnaps.hud.gov, and sam.gov. Following these steps can help you navigate the competitive nature of grant funding and improve your chances of success.

Conclusion

Tiny home grants can significantly lower the typical $100,000–$300,000 cost of building an accessory dwelling unit (ADU). State-level programs showcase how targeted funding can make a real difference. Whether you're a veteran exploring down payment assistance through Operation Tiny Home, a rural homeowner aged 62 or older looking into USDA repair grants, or a Vermont resident ready to commit to affordable rent restrictions for up to $50,000 in funding, chances are there's a program designed to fit your unique circumstances.

To make the most of these opportunities, take a close look at how each program aligns with your needs. For example, if you live in a rural area with fewer than 35,000 residents, USDA programs could be a strong option. On the other hand, if you're in a high-cost state and meet income thresholds - usually between 60% and 120% of your area's median income - state ADU grants might offer significant help. Each program comes with its own set of eligibility requirements, funding limits, and application steps, so it's crucial to research thoroughly and choose the one that best matches your location, income, and housing goals.

"To combat this disparity, promote equity, and ultimately propel the construction of much-needed housing, some states - as well as nonprofits in select cities - have established grant programs to provide assistance." - Business Insider

This highlights the importance of tailoring funding approaches to meet specific needs.

Keep in mind that funding availability can change. Always verify your eligibility and confirm that funding is active before applying. Check application deadlines and use tools like the USDA's Rural Eligibility Search to ensure your property qualifies. For the latest updates, reach out to state housing offices directly.

Success starts with preparation. Confirm your zoning status, gather all necessary documents early, secure your location and builder, and submit applications as soon as the window opens. A well-organized approach will help you navigate these competitive programs and make the most of the funding available. By aligning local conditions with program requirements, you can take a meaningful step toward achieving your tiny home goals.

FAQs

What do I need to qualify for an Operation Tiny Home grant?

To be eligible for an Operation Tiny Home grant, there are a few important requirements to meet. First, you need to be pre-qualified for financing through an accredited lender. You’ll also need to work with an approved Operation Tiny Home build partner. On top of that, you must demonstrate a hardship - this could include being affected by events like a wildfire, hurricane, or the COVID-19 pandemic - and show a clear need for both housing and financial assistance.

The application process includes filling out an online form, completing a background check, and taking part in a phone interview. The program welcomes applicants of all backgrounds, without discrimination based on race, religion, gender, disability, family status, or national origin.

Is my tiny home eligible for USDA Repair Loans or Grants?

If you're wondering whether your tiny home qualifies for USDA Repair Loans or Grants, the first step is to check if your property is in an eligible rural area. Beyond location, you need to meet a few key requirements: you must be the owner and live in the home, have a very low income, and, if applying for grants, be 62 years or older. You’ll also need to prove that you’re unable to secure affordable credit from other sources.

For more specifics, reach out to your state’s USDA Rural Development office. They can confirm your eligibility and guide you through the application process.

How can I successfully apply for a grant to build or buy a tiny home?

To increase your chances of receiving a tiny home grant, here are some practical steps to follow:

- Collaborate with an experienced builder: Work with a professional builder who specializes in tiny homes. They can help you outline your requirements and guide you through the loan pre-approval process. Many grant programs require you to partner with approved builders to meet eligibility standards.

- Get pre-approved and confirm your eligibility: Secure pre-approval for a loan through your lender and builder. Once pre-approved, your builder can assist in requesting a grant invitation if the program calls for one.

- Submit a complete application: Provide all required documents, which may include proof of financial hardship or a housing need. Some programs might also ask for a background check or an interview as part of the process.

- Keep tabs on your application: Stay connected with your builder or the program representative to track the progress of your application. Be ready to respond quickly to any additional requests or questions.

Once you've secured a grant, you might want to engage with the tiny home community through platforms like Nomad Adjacent. These networks offer opportunities to list, sell, or explore other creative living options.